Who We Are:The Bancreek Story

The initial framework for Bancreek’s investment strategy was developed by its Founder and Chief Investment Officer, Andrew Skatoff, during his time with a highly regarded, single-family investment office. The family’s goal was to compound long-term capital on a risk-adjusted basis for future generations. This ultimately led Bancreek’s Founder on a quest to identify structurally advantaged assets to invest the family’s capital. While the opportunity set consisted of all asset classes, the public equity markets presented an intriguing combination of both a global universe of diversified business models to assess and a treasure trove of data. Utilizing concepts from information theory to analyze the data more efficiently, the early constructs for Bancreek’s investment philosophy were forged, creating a powerful new lens to facilitate the search for structurally advantaged public equities to compound capital over the long-term.

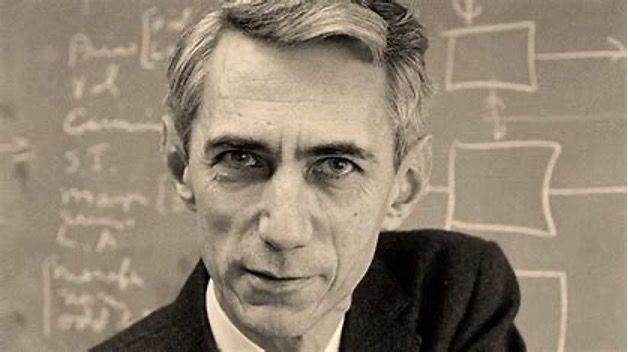

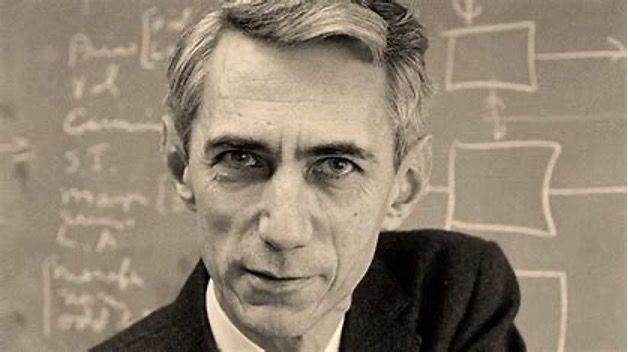

So, what is information theory? At its core, it’s the study and measurement of information, or data. The principles of information theory, initially developed at Bell Labs in the late 1940s by the brilliant polymath Claude Shannon, are best known for being the building blocks for modern communication. We have Shannon to thank, for example, every time we hop on a video call on our computers. But the theory’s reach has gone far beyond modern communications. Information theory has been applied to a plethora of fields, such as medical diagnostics, computational biology, quantum physics and - to our initial surprise (and eventual delight!) - finance. One of the theory’s lesser-known applications was investing, though much of the text on this application was highly theoretical. As tantalizing as that sounded, how could we best use the theory to apply it to all the data available in the public markets to find our edge?

Thankfully, Anton Yen (Bancreek’s Chief Data Scientist) spent most of his career applying principles of information theory, most notably during his time working at the prestigious Lawrence Livermore National Laboratory. We were enthralled with the notion of deploying that level of expertise to the field of investment management, working to develop robust, algorithmic tools that significantly improved our ability to employ the theory to identify companies with structurally advantaged business models. The output of this multi-year process was an entirely quantitative system that identifies what we believe to be the top structural compounders within a targeted investable universe. We lovingly call our proprietary system, “NOTNA” (Anton spelled backwards). NOTNA has evolved over time into a unique blend of both custom fundamental features and quantitative computations. While many quantitative investment approaches are associated with short-term trading strategies, we have done the opposite – construct and manage investment portfolios that use quantitative methods to help find edge in long-term investing.

This could have been where we put our pencils down. But Bancreek’s mission is to make edge accessible to all investors, not just investors who choose to invest with us. We realized that we could expand our impact by creating and publishing interactive visualizations, research reports, and other media on this site to help our readers bring complex data to life. Sadly, much of the granular data that influences markets (e.g. inflation) is buried in hard-to-digest text files or databases, limiting the public’s ability to make sense of it. As a result, the public must rely on others to interpret the data, which oftentimes, attempt to boil down complex situations into binary “good” or “bad” conclusions. But things are not usually this clear-cut. That’s where we think we can assist. We scour the public domain for economic data sources, clean them up, connect them, and bring them to life through interactive visualizations. Bancreek’s Chief Analytics Officer (Eric Pachman) leads this initiative. Prior to joining Bancreek, Eric founded and developed 46brooklyn Research, a 501(c)(3) non-profit that used data visualizations to illustrate and viscerally explain the problems with U.S. drug pricing. In fact, Eric has spent his career analyzing, interpreting, and presenting complex data across several markets including the drug supply chain, railroads, shipping, and energy, so who better to help us navigate complicated and not-so intuitive data sources? We believe that better insights from data can help create more astute investors. This shouldn’t be reserved for only those that know how to code. It should be available for everyone.

The team’s focus on the long-term is not limited to investing or economic data analysis. All four Bancreek partners have known each other for decades. Two members of the team even attended elementary school together, participating in the stock market game while at Banyan Creek Elementary, stoking the fire that eventually led them both into the investing world. In fact, the name “Bancreek,” was derived by combining the first syllable of “Banyan” with “Creek”.

Ultimately, Bancreek’s reason for being is to provide investors with an “edge” throughout their investment journey. For those who are looking for a structured, quantitative approach to identifying and investing in structurally advantaged businesses, consider visiting bancreeketfs.com for more information. For others who are looking for a different way to analyze data on all sorts of investing and economic topics, our interactive visualizations and research have been designed for you. Either way, we are honored to be of assistance to you on your investing journey!

Team Bancreek

Enjoying this content?

Tell others about it.